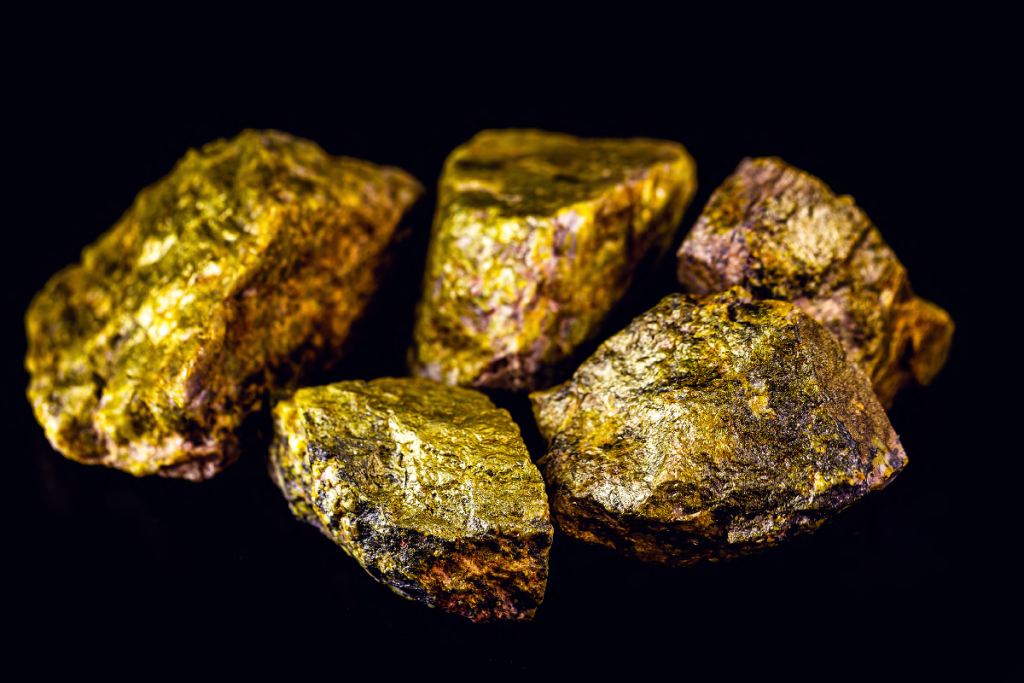

The Importance Of Invesing In Uranium In The Evolving Power Sector

Investing in uranium is important for investors that want to make profitable venture in the dynamic power sector. The need for uranium is predicted to rise as the globe shifts to healthier as well as more environmentally friendly energy sources.

You will be equipped with the knowledge and comprehension required to effectively understand the globe of investing in uranium and make wise judgments by the time you finish reading this article.

Journey with us @ Zik Natural Resources, as we explore all the facets of investing in uranium in this extensive article, covering the various types of uranium investments, the advantages of doing so, and how to choose the best investment for Uranium.

Various Types of Investing In Uranium

There are a variety of uranium investment options available to investors, each has its specific features.

- Investing in uranium can be done directly through buying and preserving of physical uranium or by means of exchange-traded funds, that specialise in uranium. These financial investments offer a vulnerability to fluctuations in the market value of uranium.

- Purchasing stock in uranium mining firms is an additional choice. These businesses are engaged in uranium exploration, mining, and manufacturing. By purchasing uranium mining equities, one can profit from the mining firms’ efficiency and profitability, even if there is a future increase in uranium prices.

- An alternate strategy for investing is provided by uranium royalty Corp. These businesses give uranium manufacturers, advance funding in return for permission to buy their subsequent supply at a fixed price. Despite the logistical hazards connected with mining firms, investing in uranium royalty companies can offer investors a wide range accessibility to several uranium properties.

- Investing in uranium-based energy firms. Nuclear energy facilities are an important consumer of uranium and these organisations play a role in their implementation and administration. By making investments in nuclear power firms, investors can profit implicitly from the expansion of the atomic energy sector and the growing marketplace for uranium.

Subscribe to www.zikresources.com for more interesting content

Advantages of Investing In Uranium

For astute investors, uranium investments provide several advantages.

- First of all, since uranium is a limited resource, its worth may increase as long as the desire to purchase it rises. Globally, the need for uranium is predicted to rise rapidly, as the use of nuclear power generation increases, in pursuit of an environmentally friendly future.

- The possibility for considerable profits is another benefit of investing in uranium. When there’s a noticeable upsurge in uranium rates, investors can earn handsomely from the resulting price increase. It’s crucial to remember that, similar with other investments, uranium mining entails risk.

- Investing in uranium might also act as an insurance policy in opposition to rising prices. Purchasing a physical item like uranium can offer a certain degree of inflation safety, as the worth of conventional currencies varies. Due to its limited availability and the rising need for nuclear energy, uranium is becoming a more desirable investment for people seeking opportunities for diversification and protect their capital.

Subscribe to www.zikresources.com for more valuable updates

The Appropriate Strategy For Investing In Uranium

Selecting the appropriate uranium investment plan is essential for optimising returns and successfully controlling risks.

The following points should be considered:

- Tolerance for Risk: Assess your level of financial risk acceptability and decide what level of unpredictability, you can handle. Consider investing in more conservative assets, including physical uranium or uranium-focused exchange-traded funds. Another option, you may consider investing in nuclear powered firms or uranium mining assets, assuming you’re prepared and determined, to take on greater risks in exchange for substantially larger profits.

- Investigation and Thorough meticulousness: Prior to considering any choices regarding investments, make sure you’ve done a lot of inquiry as well as, careful consideration. Examine the uranium market’s fundamentals, the long-term sustainability of the organisations you are evaluating, and the state of the industry as a whole. Follow up with updates in the geopolitical landscape, trends in the sector, and modifications to regulations, that may affect uranium pricing and investment prospects.

- Contact with Experts in the field: If you are unfamiliar with uranium investing or lack experience in the area, you might want to speak with financial experts or investment trained professionals, who focus on the energy industry. They can offer insightful advice and useful perspectives to support you in making wise investing choices.

Subscribe to www.zikresources.com and click on Uranium exploration to get detailed explanation.

In conclusion, there are pros and cons to uranium investment. Although prices may rise due to the increasing need for thermal power as well as renewable energy, caution must be taken due to geopolitical considerations, regulatory obstacles, and market instability.

Before thinking about uranium as an investment choice, investors should evaluate their risk acceptability, broaden their investment strategies, and do detailed investigation.

If this article has been an educative content for you, don’t forget to subscribe to www.zikresources.com for more intriguing information and updates.